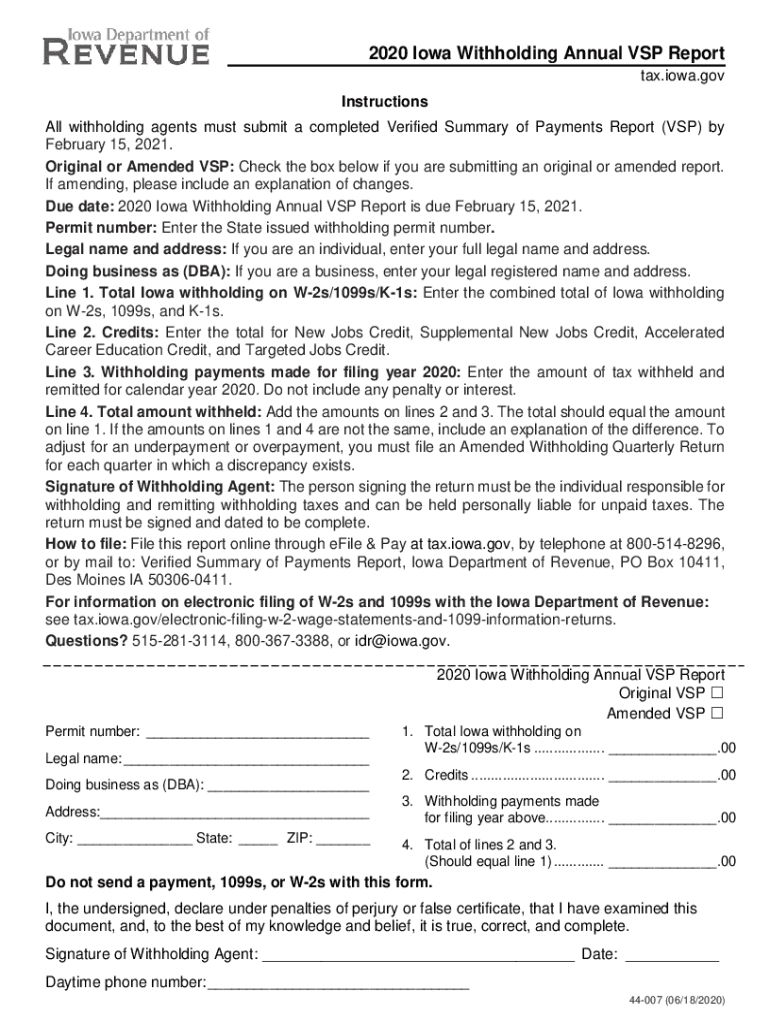

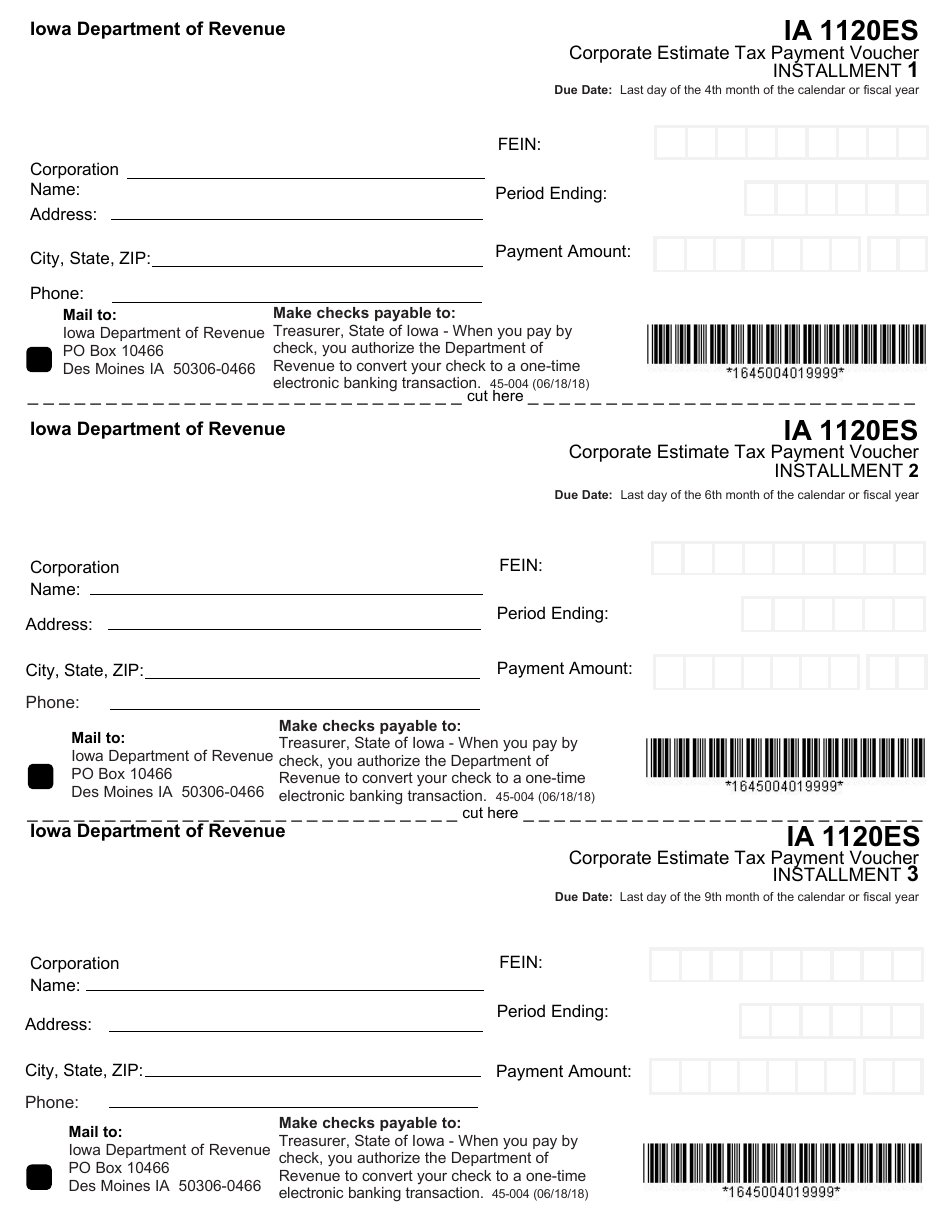

Iowa State Taxes 2025. Employers must withhold iowa income tax from their wages. Division iii of this legislation amends iowa code section 422.16 to clarify that state income tax withholding is not required on distributions of retirement income that are not subject to iowa.

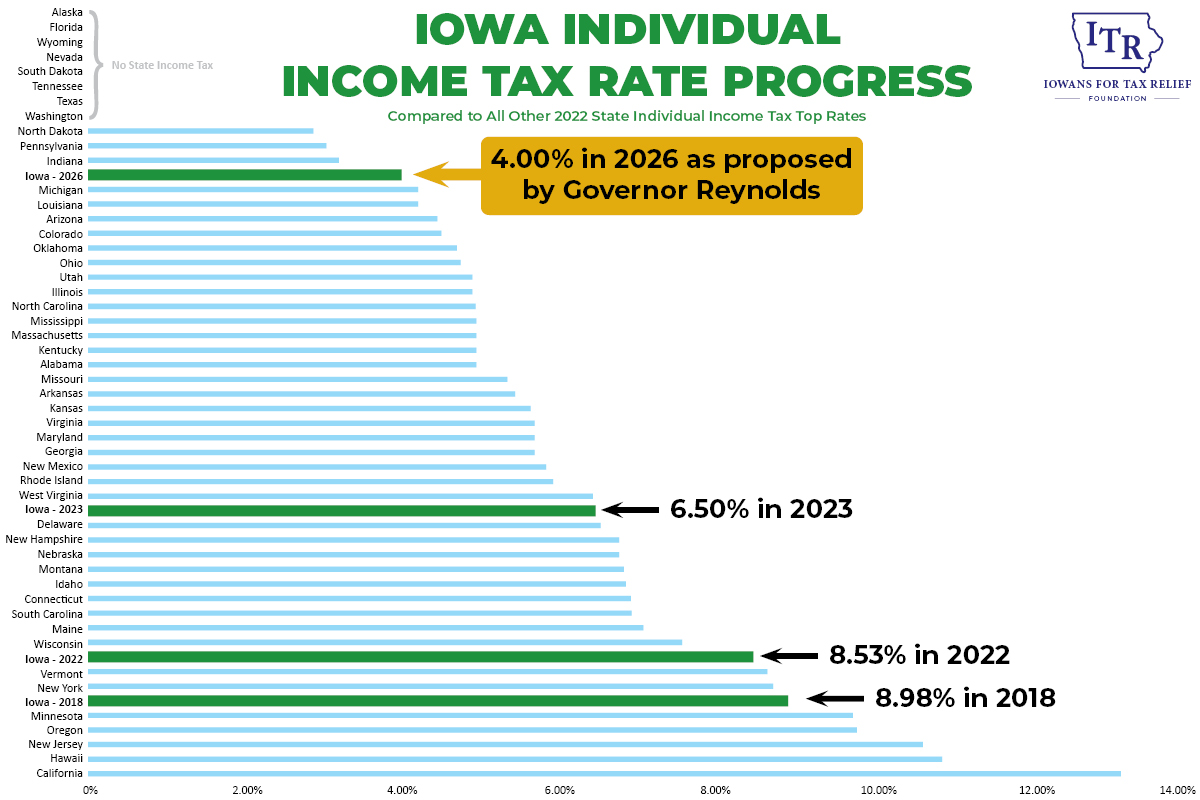

The iowa department of revenue announces the 2025 tax year individual income tax rate and the 2025 interest rate, which the agency charges for overdue payments. Kim reynolds signed a nearly $1 billion tax cut into law wednesday that will lower the state’s personal income tax to a flat rate of 3.8% in 2025.

Iowa State Tax 2025 Isaac Gray, Iowa no longer taxes retirement income for taxpayers 55 or older.

Iowa State Tax 2025 Isaac Gray, The iowa department of revenue has finalized individual income tax brackets for the 2025 tax year (applicable for taxes due in 2025) and the 2025 interest rate, which the agency charges for overdue payments.

Iowa State Tax 2025 Isaac Gray, The latest changes to iowa's tax code are expected to reduce state revenues by more than $1 billion over the first three years, and more than $1.3 billion through fiscal year 2030.

Iowa Tax Changes Effective January 1, 2025 ITR Foundation, You can quickly estimate your iowa state tax and federal tax by selecting the tax year, your filing status, gross income and gross expenses, this is a great way to compare salaries in iowa and for quickly estimating your tax commitments.

Iowa State Tax 2025 Isaac Gray, Her proposal would bring the tax the current 5.7% rate to 3.65% in 2025, applied retroactively to the beginning of the year, with a drop to 3.5% in 2025.

Another Banner Year for State Tax Cuts Will Iowa Continue to Lead in, Employers must withhold iowa income tax from their wages.