2025 Limit For Hsa. Hsa contribution limits for 2025. What to know about the ‘significant increase,’ says advisor.

The maximum amount that may be made newly available for plan years beginning in 2025 for excepted benefit hras is $2,100 (up $150 from 2025).

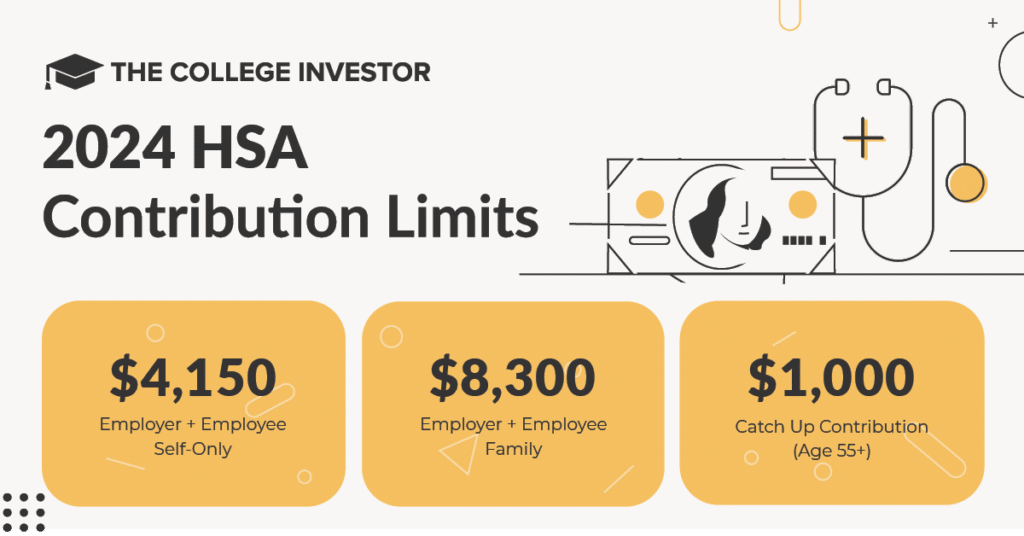

Significant HSA Contribution Limit Increase for 2025, For 2025, individuals under a high deductible health plan (hdhp) have an hsa annual contribution limit of $4,150. For 2025, you can contribute up to $4,150 if you have individual coverage, up from.

Significant HSA Contribution Limit Increase for 2025, What to know about the ‘significant increase,’ says advisor. $1,500 single plan $3,000 family plan.

New Amt Threshold 2025 Limit adrian andriana, Those 55 and older can contribute. But if you do have an fsa in 2025, here are the maximum amounts you can contribute for 2025 (tax returns normally filed in 2025).

Hsa Contributions 2025 Ardys Winnah, For 2025, you can contribute up to $4,150 if you have individual coverage, up from. Annual hsa contribution limits for 2025 are increasing in one of the biggest jumps in recent years, the irs announced may 16:

The Best Order of Operations For Saving For Retirement, The health savings account (hsa) contribution limits increased from 2025 to 2025. For 2025, you can contribute up to $4,150 if you have individual coverage, up from.

Hsa 2025 Family Limit Ciel Melina, The limit for families will be $8,300. Annual hsa contribution limits for 2025 are increasing in one of the biggest jumps in recent years, the irs announced may 16:

HSA/HDHP Contribution Limits Increase for 2025, $1,600 single plan $3,200 family plan. Annual hsa contribution limits for 2025 are increasing in one of the biggest jumps in recent years, the irs announced may 16:

Irs Limits For 2025 Melva Sosanna, The maximum amount that may be made newly available for plan years beginning in 2025 for excepted benefit hras is $2,100 (up $150 from 2025). The 2025 hsa contribution limit for families is $8,300, a 7.

IRS Raises HSA Contribution Limits for 2025 Due to High Inflation, The hsa adjustments for individuals jumped 7.8% for 2025 compared to the previous year and increased 7.1% for family contributions, representing a $300 and $550 limit increase, respectively. Hsa contribution limits for 2025 are $4,150 for singles and $8,300 for families.

Fsa 2025 Contribution Limits Clara Demetra, For 2025, the maximum hsa contribution will jump to $8,300 for a family and $4,150 for an individual. Employer contributions count toward the annual hsa contribution.

For 2025, the maximum hsa contribution will jump to $8,300 for a family and $4,150 for an individual.